TD Bank Group Newsroom

Revealing the realities of retirement savings

- TD poll finds some surprising misconceptions about planning for retirement -

TORONTO, Feb. 2, 2012 /CNW/ - Canadians have a variety of misconceptions about their finances for retirement, from when they should start saving to the amount they will need, according to a recent TD poll. With the RRSP deadline coming up on February 29, 2012, time is of the essence to separate the myths from reality to help Canadians plan appropriately for their retirement.

"While planning and saving for retirement is different for everyone, there are some basic fundamentals to keep in mind with respect to things like when to start saving, how much you need to save and weathering the stormy markets," says Crystal Wong, Senior Regional Manager, TD Waterhouse Financial Planning. "An important starting point is to determine what your ideal retirement lifestyle is like, then set financial goals and work with an advisor to develop a comprehensive plan to help you attain those goals. This will help you feel more confident about your financial future."

Wong unveils some of the myths held by Canadians about retirement financial planning and provides advice to Canadians about how they can act now in order to achieve their dream retirement:

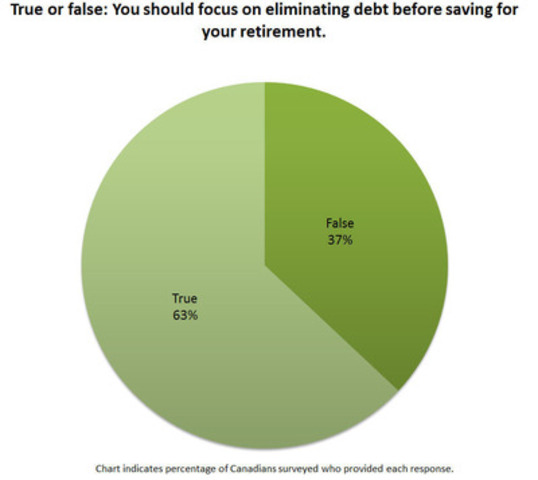

Myth: You should focus on eliminating debt before saving for your retirement.

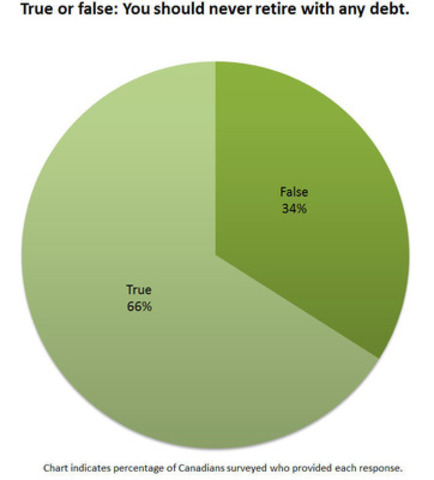

The majority of Canadians (63%) think you should focus on eliminating debt before saving for retirement, and 66% also feel you should never retire with debt.

"Retiring without any debt may not be realistic for some Canadians. It's important to pay down as much debt as possible before retiring, but it's also essential to strike a balance between reducing debt and saving for retirement," says Wong. "The first step is to review your current financial situation and your retirement goals. This is where an advisor comes in. They can help you formalize a financial plan that works towards eliminating your debt, starting with any high-interest debt, so you can get on the right track for your financial future."

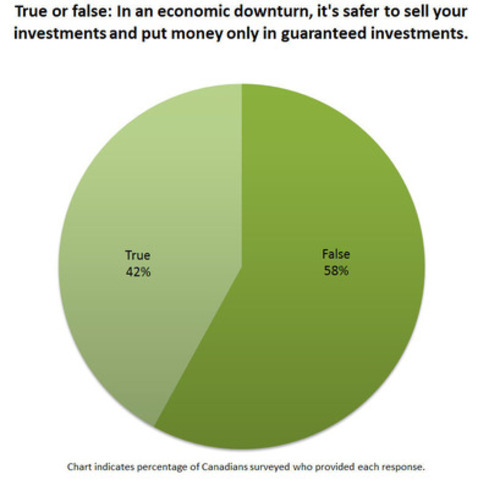

Myth: In an economic downturn it's safer to sell your investments and only put your money in guaranteed investments.

Forty-two percent of Canadians believe that putting money only in guaranteed investments or selling investments is the safest strategy during an economic downturn.

"The reality is there will always be fluctuations in the markets, but that doesn't mean you should sell and run. In times of market volatility it's essential to stick to your plan and not react emotionally," says Wong. "Just as saving for retirement is a long-term process, having your money in the equity market is a long-term investment. An advisor can help you determine the right asset allocation for your portfolio, which will optimize potential returns without exposure to inappropriate levels of risk."

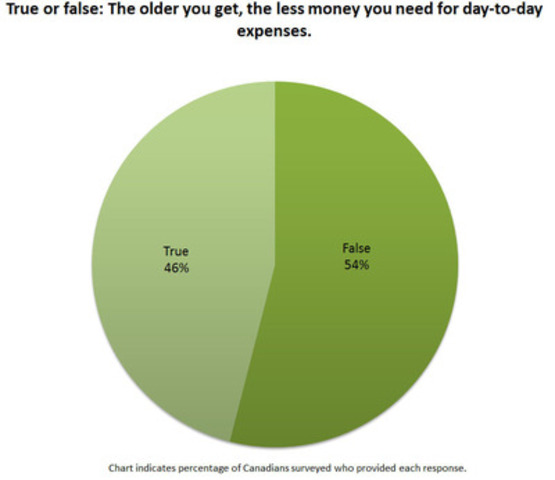

Myth: The older you get, the less money you will spend/need for day-to-day expenses.

Almost half (46%) of Canadians believe your expenses will decrease as you age.

"Despite the fact that our expenses may decrease as we enter our retirement years, recent surveys of retired Canadians have told us that their daily expenses are higher than they anticipated. This may be because they haven't taken into account everyday expenses such as dental and health care, or unforeseen expenses such as accidents or home repair," says Wong. "You should work with an advisor to estimate what your expenses will be in retirement, and calculate to ensure that you are saving enough now to pay for these future expenses when you probably will not be generating as much income."

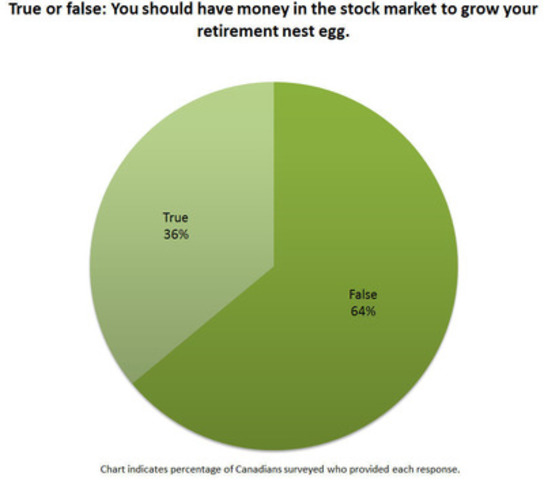

Myth: You don't need to have money in the stock market to grow your retirement nest egg.

Only 36% of Canadians believe that investing in the stock market is an important way to establish a financially-secure retirement.

"Similar to many things in life, when it comes to retirement savings, it's important to ensure you establish a good balance," adds Wong. "With the recent volatility in the markets, you can help protect your retirement nest egg by having a variety of investments and savings products, including equities, bonds, and savings vehicles such as an RRSP or TFSA. Your portfolio should also contain a mix of conservative and more aggressive investments, depending on the number of years you have until retirement and your comfort level, which will help you maximize your retirement savings."

TD 'Retirement Mythbusters' Quiz

How much do you know about being on the right track for your retirement savings? Can you separate the myths from reality? Take this easy quiz to find out.

True or false?

1. The odds are I won't live to 90, so I don't need to plan for my money to

last.

False: The reality is that Canadians are living longer than ever before, many

into their nineties. Therefore it's important to ensure that you have

enough savings so you don't have to worry about outliving your money.

2. The best time to start saving for retirement is when you're about 40

or when you're more established financially.

False: While it's never too late to start saving, it's best to start as early

as possible, ideally when you are finished school and have a full-time

job. The sooner you start saving, the more time your money has to grow,

and the larger your retirement nest egg will be.

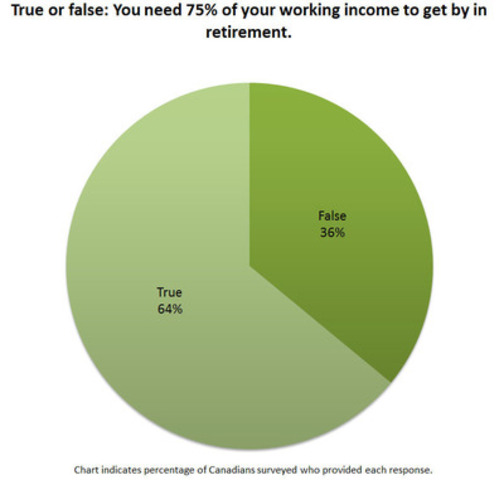

3. You need 75% of your working income to get by in your retirement.

True: Depending on what you plan to do in retirement, and whether or not you

have any debt, it's safe to estimate that you will need 60-80% of your

working income to continue to lead the same lifestyle in retirement

that you had during your working years.

4. The best way to fund your retirement is through the equity in your

home.

False: While relying on the sale of your home is a good way to boost your

retirement savings, unless you're planning to downsize significantly,

it likely won't generate enough money to last throughout your golden

years. It's important to ensure you have additional savings and

investments, such as money in an RRSP, TFSA, pension or equities.

5. You need to have a lot of money to invest in an RRSP.

False: Saving a small amount as soon as you start working full time, and

increasing the amount you invest as you earn more money, can result in

a rather golden nest egg thanks to the power of compound interest and

dividends.

About the TD Poll:

Results for this study were collected through a custom, online survey

fielded by Environics Research Group. A total of 1,006 completed

surveys were collected with Canadians aged 25-64 who are not retired.

Data was collected between November 22-December 2, 2011.

About TD Bank Group

The Toronto-Dominion Bank and its subsidiaries are collectively known as

TD Bank Group (TD). TD is the sixth largest bank in North America by

branches and serves approximately 20.5 million customers in four key

businesses operating in a number of locations in key financial centres

around the globe: Canadian Personal and Commercial Banking, including

TD Canada Trust and TD Auto Finance Canada; Wealth and Insurance,

including TD Waterhouse, an investment in TD Ameritrade, and TD

Insurance; U.S. Personal and Commercial Banking, including TD Bank,

America's Most Convenient Bank, and TD Auto Finance U.S.; and Wholesale

Banking, including TD Securities. TD also ranks among the world's

leading online financial services firms, with more than 7.5 million

online customers. TD had CDN $733 billion in assets on October 31,

2011.

About TD Waterhouse

TD Waterhouse represents the products and services offered by TD

Waterhouse Canada Inc. (Member - Canadian Investor Protection Fund), TD

Waterhouse Private Investment Counsel Inc., TD Waterhouse Insurance

Services Inc., TD Waterhouse Private Banking (offered by The

Toronto-Dominion Bank) and TD Waterhouse Private Trust (offered by The

Canada Trust Company). TD Waterhouse Financial Planning is a division

of TD Waterhouse Canada Inc.

PDF with caption: "TD Waterhouse Retirement Mythbusters - True or False Quiz". PDF available at: http://stream1.newswire.ca/media/2012/02/02/20120202_C8599_DOC_EN_9514.pdf

Image with caption: "You should never retire with any debt (CNW Group/TD Bank Group)". Image available at: http://photos.newswire.ca/images/download/20120202_C8599_PHOTO_EN_9505.jpg

Image with caption: "You should have money in the stock market to grow your retirement nest egg (CNW Group/TD Bank Group)". Image available at: http://photos.newswire.ca/images/download/20120202_C8599_PHOTO_EN_9506.jpg

Image with caption: "You should focus on eliminating debt before saving for your retirement (CNW Group/TD Bank Group)". Image available at: http://photos.newswire.ca/images/download/20120202_C8599_PHOTO_EN_9507.jpg

Image with caption: "You need 75% of your working income to get by in retirement (CNW Group/TD Bank Group)". Image available at: http://photos.newswire.ca/images/download/20120202_C8599_PHOTO_EN_9508.jpg

Image with caption: "The older you get, the less money you need for day-to-day expenses (CNW Group/TD Bank Group)". Image available at: http://photos.newswire.ca/images/download/20120202_C8599_PHOTO_EN_9509.jpg

Image with caption: "In an economic downturn, it's safer to put money only in guaranteed investments (CNW Group/TD Bank Group)". Image available at: http://photos.newswire.ca/images/download/20120202_C8599_PHOTO_EN_9510.jpg

PDF with caption: "TD Retirement Mythbusters - BC Fact Sheet". PDF available at: http://stream1.newswire.ca/media/2012/02/02/20120202_C8599_DOC_EN_9517.pdf

PDF with caption: "TD Retirement Mythbusters - Alberta Fact Sheet". PDF available at: http://stream1.newswire.ca/media/2012/02/02/20120202_C8599_DOC_EN_9519.pdf

PDF with caption: "TD Retirement Mythbusters - Manitoba-Saskatchewan Fact Sheet". PDF available at: http://stream1.newswire.ca/media/2012/02/02/20120202_C8599_DOC_EN_9516.pdf

PDF with caption: "TD Retirement Mythbusters - Ontario Fact Sheet". PDF available at: http://stream1.newswire.ca/media/2012/02/02/20120202_C8599_DOC_EN_9515.pdf

PDF with caption: "TD Retirement Mythbusters - Atlantic Canada Fact Sheet". PDF available at: http://stream1.newswire.ca/media/2012/02/02/20120202_C8599_DOC_EN_9518.pdf

Ali Duncan Martin

TD Bank Group

416-983-4412

Ali.DuncanMartin@td.com

Karen Williams / Steve Presant

Paradigm Public Relations

416-203-2223

kwilliams@paradigmpr.ca / spresant@paradigmpr.ca

Get News Alerts by Email

Receive breaking news from TD Bank Group directly to your inbox.