TD Bank Group Newsroom

Generations Unite: Boomers, Gen X and Gen Y Say Retirement Begins Before 65

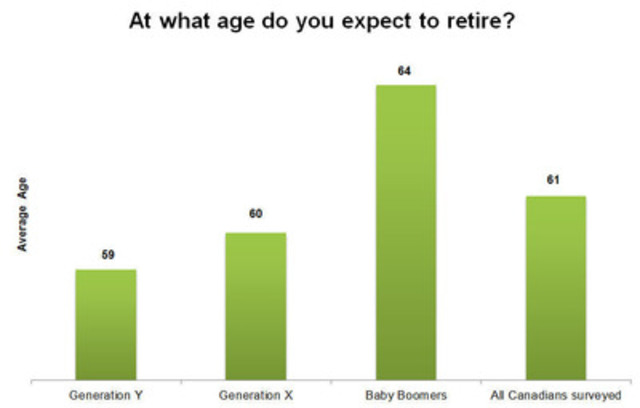

- TD Age of Retirement Report reveals 61 is average age Canadians expect to retire

- TD's Cynthia Caskey offers advice for reaching retirement age in good financial shape

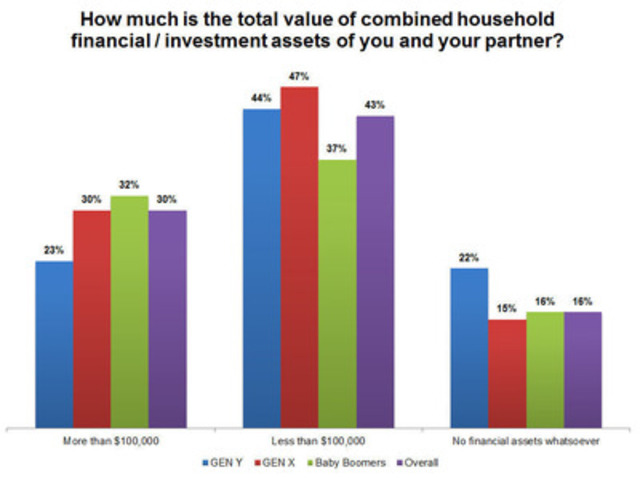

TORONTO, Jan. 5, 2012 /CNW/ - Canadians across three generations want to retire before 65, but will they be financially prepared to achieve that goal? According to the TD Age of Retirement Report, 61 is the average age of expected retirement for Canadians, and the average is lower for those in Generation X (ages 31-46) who plan to retire at age 60, and those in Generation Y (ages 25-30) who plan to retire at age 59. However, nearly six in ten (59%) of Canadians say they have less than $100,000 in household financial assets.

"An early retirement is only achievable if you take the steps needed to get there," says Cynthia Caskey, Vice President and Portfolio Manager, TD Waterhouse Private Investment Advice. "Our research suggests that many Canadians feel they are behind when it comes to getting their finances in order for retirement, but this doesn't have to be the case. Early retirement may be an option, as long as you take the time to do the proper planning, including a comprehensive financial plan, as well as disciplined investing over the long term. Investments can be made in a variety of different savings tools, including Registered Retirement Savings Plans (RRSPs) or Tax-Free Savings Accounts (TFSAs). An in-depth conversation with an advisor is the best place to start."

Canadians and their finances

While retiring at 61 may be the expectation, people may not be taking into account the amount of savings and investments they'll need to last through their retirement years. In fact, more than half (53%) of Boomers (ages 47-64) and 62% of those in Generation X say they have less than $100,000 in household financial assets, not including company pensions, life insurance policies and home equity. Sixteen percent of Canadians say they have no financial assets whatsoever.

"To ensure their golden years are actually golden, it is extremely important for Canadians to get an early start on saving for retirement," says Caskey. "Retirement savings tools like RRSPs really work well if you start making contributions early in your working life. This gives you a chance to grow your savings over time, thanks to regular contributions and the power of compound interest."

"However, if you're nearing your retirement age and don't have significant savings, don't despair. The old adage of 'better late than never' definitely applies in this case. Work with an advisor to determine some realistic goals - and the steps you can take to reach them," says Caskey.

Canadians, debt and retirement

Another major consideration for Canadians when it comes to retirement is debt - something that almost half (44%) expect to have when they retire, including one in ten (13%) who believe they will retire with a significant amount of debt. Most of the debt Canadians expect to carry into retirement is consumer debt (57%) followed by mortgage debt (48%).

"You should take a close look at your debt levels, and really work to reduce or eliminate bad debt, which is debt that has a high interest rate, such as credit cards," says Caskey. "If you are carrying significant debt, it's important to reduce it by as much as possible before you stop working."

What does retirement mean for Canadians?

Not surprisingly, most Canadians anticipate retirement will either be a time to relax and really enjoy life, or to try something new, with only 15% saying they plan to work for the rest of their healthy lives. For almost half (47%) of Canadians, retirement is a time where they can gradually slow down and enjoy life by spending more time with friends and family, while 38% say retirement is a time to explore passions and experience new things they weren't able to while working.

"Retirement should be the time in our lives where we're able to carve out a lifestyle that is meaningful to us, but remember, it takes careful planning and financial discipline to get there," adds Caskey. "We need to be emotionally invested in the vision of our ideal future. That means being accountable for the short-term goals and priorities we set for ourselves. Don't let this be just another new year's resolution to save more money - your retirement dream and the steps you take to work towards it should be something that remains a priority over the years."

About the TD Age of Retirement Report

Results for the TD Age of Retirement Report were collected through a custom, online survey fielded by Environics Research Group. A total of 1,006 completed surveys were collected with Canadians ages 25-64 who are not retired. Data was collected between November 22 and December 2, 2011.

About TD Bank Group

The Toronto-Dominion Bank and its subsidiaries are collectively known as TD Bank Group (TD). TD is the sixth largest bank in North America by branches and serves approximately 20.5 million customers in four key businesses operating in a number of locations in key financial centres around the globe: Canadian Personal and Commercial Banking, including TD Canada Trust, TD Insurance, and TD Auto Finance Canada; Wealth Management, including TD Waterhouse and an investment in TD Ameritrade; U.S. Personal and Commercial Banking, including TD Bank, America's Most Convenient Bank, and TD Auto Finance U.S.; and Wholesale Banking, including TD Securities. TD also ranks among the world's leading online financial services firms, with more than 7.5 million online customers. TD had CDN$686 billion in assets on October 31, 2011. The Toronto-Dominion Bank trades under the symbol "TD" on the Toronto and New York Stock Exchanges.

About TD Waterhouse

TD Waterhouse represents the products and services offered by TD Waterhouse Canada Inc. (Member - Canadian Investor Protection Fund), TD Waterhouse Private Investment Counsel Inc., TD Waterhouse Insurance Services Inc., TD Waterhouse Private Banking (offered by The Toronto-Dominion Bank) and TD Waterhouse Private Trust (offered by The Canada Trust Company).

PDF with caption: "TD Age of Retirement Report - English". PDF available at: http://stream1.newswire.ca/media/2012/01/05/20120105_C2113_DOC_EN_8634.pdf

Image with caption: "Average age Canadians expect to retire (CNW Group/TD BANK GROUP)". Image available at: http://photos.newswire.ca/images/download/20120105_C2113_PHOTO_EN_8614.jpg

Image with caption: "Canadians - Total Value of Assets (CNW Group/TD BANK GROUP)". Image available at: http://photos.newswire.ca/images/download/20120105_C2113_PHOTO_EN_8616.jpg

PDF with caption: "TD Age of Retirement Report - Alberta Fact Sheet ". PDF available at: http://stream1.newswire.ca/media/2012/01/05/20120105_C2113_DOC_EN_8622.pdf

PDF with caption: "TD Age of Retirement Report - British Columbia Fact Sheet". PDF available at: http://stream1.newswire.ca/media/2012/01/05/20120105_C2113_DOC_EN_8623.pdf

PDF with caption: "TD Age of Retirement Report - Manitoba-Saskatchewan Fact Sheet ". PDF available at: http://stream1.newswire.ca/media/2012/01/05/20120105_C2113_DOC_EN_8624.pdf

PDF with caption: "TD Age of Retirement Report - Ontario Fact Sheet". PDF available at: http://stream1.newswire.ca/media/2012/01/05/20120105_C2113_DOC_EN_8625.pdf

PDF with caption: "TD Age of Retirement Report - Atlantic Canada Fact Sheet ". PDF available at: http://stream1.newswire.ca/media/2012/01/05/20120105_C2113_DOC_EN_8627.pdf

Ali Duncan Martin

TD Bank Group

416-983-4412

Ali.DuncanMartin@td.com

Karen Williams / Steve Presant

Paradigm Public Relations

416-203-2223

kwilliams@paradigmpr.ca / spresant@paradigmpr.ca

Get News Alerts by Email

Receive breaking news from TD Bank Group directly to your inbox.