TD Bank Group Newsroom

Great Tax-pectations: Canadians anticipate substantial refunds in 2016

TD offers advice on how to maximize this year's tax refund at any life stage

TORONTO, April 11, 2016 /CNW/ - With tax season quickly approaching, the majority of Canadians have great tax-pectations, with nearly six in 10 (57 per cent) saying they expect to receive a tax refund this year, according to a recent TD survey. Of those anticipating a refund, 61 per cent expect to receive up to $1,499. While it can be tempting to view a tax refund as extra money for instant gratification, a tax refund can have a greater impact when it's incorporated into a broader financial plan.

"There are many ways to use your tax refund based on the priorities you face in your life stage , like getting ready to buy a home, planning to expand your family or saving for retirement," said Linda MacKay, Senior Vice President, Personal Savings and Investing, TD Canada Trust. "While you can spread it across several different financial priorities, you can also consider allocating the full sum towards one or two goals to fully maximize the returns' potential."

The TD survey revealed that the top three financial goals for Canadians include paying off credit card debt (32 per cent), contributing to an RRSP or TFSA (31 per cent), and adding to their emergency fund (28 per cent).

MacKay says that setting personal short and long-term financial goals can help Canadians decide the best course of action for allocating their tax refund. Taking these goals in context with key lifestyle priorities over the next three, five and 10 years, like starting a family or looking for a new job, can help bring clarity to where a tax return will leave the biggest impression on an individual's unique financial situation.

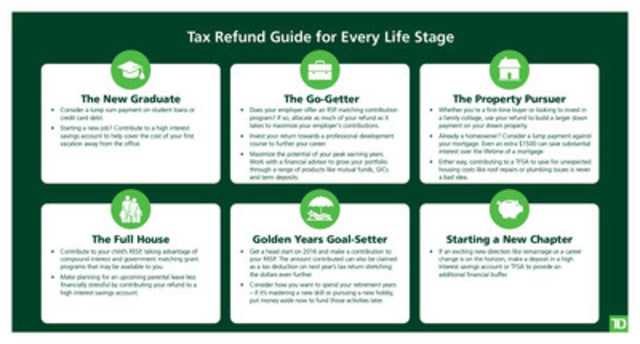

For those using life stages to help determine where to allocate their refund, MacKay offers the following tips:

Tax Refund Guide for Every Life Stage

- The Graduate

- Consider a lump sum payment on student loans or credit card debt.

- Starting a new job? Contribute to a high interest savings account to help cover the cost of your first vacation away from the office.

- The Go - Getter

- Does your employer offer an RSP matching contribution program? If so, allocate as much of your refund as it takes to maximize your employer's contributions.

- Invest your return towards a professional development course to further your career.

- Maximize the potential of your peak earning years. Work with a financial advisor to grow your portfolio through a range of products like mutual funds, GICs and term deposits.

- The Property Pursuer

- Whether you're a first-time buyer or looking to invest in a family cottage, use your refund to build a larger down payment on your dream property.

- Already a homeowner? Consider a lump payment against your mortgage. Even an extra $1500 can save substantial interest over the lifetime of a mortgage.

- Either way, contributing to a TFSA to save for unexpected housing costs like roof repairs or plumbing issues is never a bad idea.

- The Full House

- Contribute to your child's RESP, taking advantage of compound interest and government matching grant programs that may be available to you.

- Make planning for an upcoming parental leave less financially stressful by contributing your refund to a high interest savings account.

- Golden Years Goal-Setter

- Get a head start on 2016 and make a contribution to your RRSP. The amount contributed can also be claimed as a tax deduction on next year's tax return stretching the dollars even further.

- Consider how you want to spend your retirement years – if it's mastering a new skill or pursuing a new hobby, put money aside now to fund those activities later.

- Starting a New Chapter

- If an exciting new direction like remarriage or a career change is on the horizon, make a deposit in a high interest savings account or TFSA to provide an additional financial buffer.

MacKay adds that many Canadians, regardless of life stage, have multiple financial priorities that often compete – for example, saving for the future and paying down debt.

"If you're feeling overwhelmed and need guidance on the best way to use your tax refund, visit your local TD branch," said MacKay. "We can help you make informed decisions about your financial reality to maximize your tax refund's potential to help you achieve your financial goals."

About the TD Bank Group Poll

TD Bank Group commissioned Environics Research Group to conduct a custom survey of 6,337 Canadians aged 18 and older. Responses were collected between February 25 and March 17, 2016. Canadians and a subgroup of Canadians who expect to receive a tax refund are included in this report.

About TD Canada Trust

TD Canada Trust offers personal and business banking to more than 11.5 million customers. We provide a wide range of products and services from chequing and savings accounts, to credit cards, mortgages and business banking, plus credit protection and credit travel medical insurance, as well as advice on managing everyday finances. TD Canada Trust makes banking comfortable with award-winning service and convenience through 24/7 mobile, internet, telephone and ATM banking, as well as at over 1,100 branches, with convenient hours to serve customers better. For more information, please visit: www.tdcanadatrust.com. TD Canada Trust is the Canadian retail bank of TD Bank Group, the sixth largest bank in North America.

SOURCE TD Bank Group

Image with caption: "Tax Refund Guide for Every Life Stage (CNW Group/TD Bank Group)". Image available at: http://photos.newswire.ca/images/download/20160411_C6336_PHOTO_EN_660986.jpg

Get News Alerts by Email

Receive breaking news from TD Bank Group directly to your inbox.