TD Bank Group Newsroom

Canadians say "yes to debt" to help finance life's firsts

-- TD Canada Trust Report on Savings finds 40% of Canadians say it's a real struggle to save, so many rely on loans and credit cards to pay for life's milestones --

-- TD Canada Trust infographic on how to save for life's firsts available at: http://photos.newswire.ca/images/download/20120604_C5170_PHOTO_EN_14511.jpg --

TORONTO, June 4, 2012 /CNW/ - First job and car, home, wedding, and child - paying for life's milestones can add up, so how do Canadians find the money to cover them all? According to the TD Canada Trust Report on Savings, they don't - at least not upfront. Forty percent of Canadians find it a real struggle or impossible to save, so many of them rely on loans and lines of credit, credit cards and the kindness of friends and family to fill the gaps.

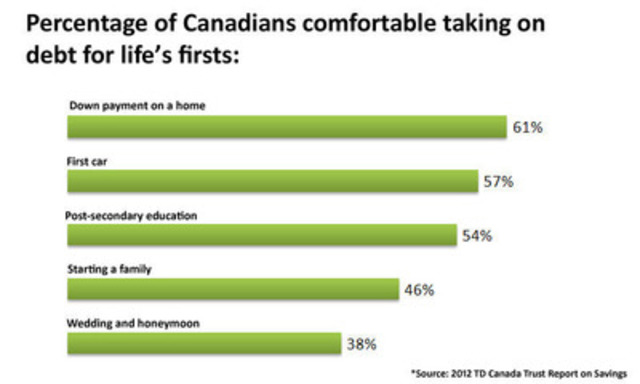

The report found the majority of Canadians say they are comfortable taking on debt when it comes to financing a down payment on a home (61%), buying their first car (57%), paying for post-secondary education (54%), starting a family (46%), and paying for their wedding and honeymoon (38%).

"A wedding, a car, a home - these are major costs. It can be difficult to juggle them, especially when they seem to come all at once," says Kevin Moffatt, Vice President, TD Canada Trust. "There are financing options available to help you fill the gaps, but the key to being able to afford and enjoy life's milestones is smart planning, patience and saving early and regularly."

Moffatt adds that using credit to afford major purchases can leave you with payments long after the initial excitement of the milestone has passed.

"A general rule is that your total monthly debt payments should not equal more than 40% of your gross monthly income. When you have several big expenses on the horizon, keep this guideline in mind to determine if you need to cut back or postpone a purchase to save up a bit longer," he says.

Moffatt offers his advice on the key factors to consider when saving and budgeting for three of life's big milestones:

| 1. | Your first car |

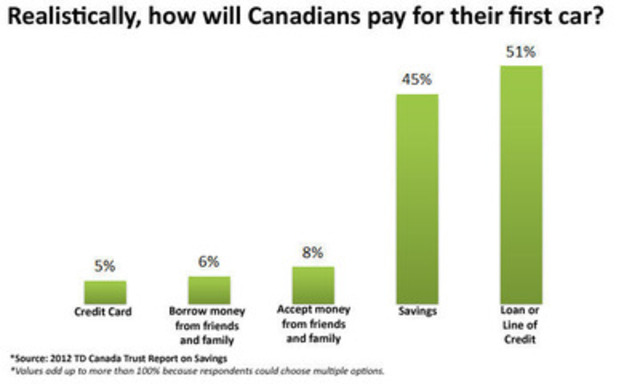

| The average price of a new car in Canada is approximately $33,000, but that doesn't include the additional expenses of owning and maintaining a car like insurance, maintenance, registration and gas. Men are more likely than women to be comfortable taking on debt to buy a car (62% vs. 53%), and one-in-two Canadians (51%) say they did or would take out a loan or line of credit to finance their first set of wheels. | |

| "It's important to do your research and know what type of vehicle will meet your needs and budget," says Moffatt. "After you work out what you can afford to spend on a car, aim to save at least 20% of the amount for the down payment. Larger down payments will lower your monthly payment and allow you to stay on budget with your monthly finances." | |

| 2. | Your wedding and honeymoon |

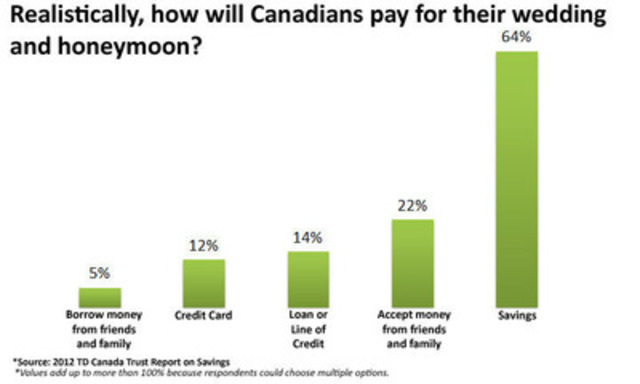

| The average cost of a wedding in Canada is $20,000, so it's no surprise that newlyweds tend to reach out to their family and friends (22%), secure a loan or line of credit (14%) or even pull out their credit card (12%) to cover the costs of their big day and honeymoon. | |

| "Planning your wedding can be fun and exciting, stressful and expensive all at once. It's important to review your finances and set a realistic budget that you'll stick to," says Moffatt. "This should be as specific as breaking down set amounts for the essentials, such as the venue, invitations, dress and transportation. You don't want to start off your marriage by accumulating a lot of wedding debt that you'll be paying for years." | |

| 3. | Down payment on your first home |

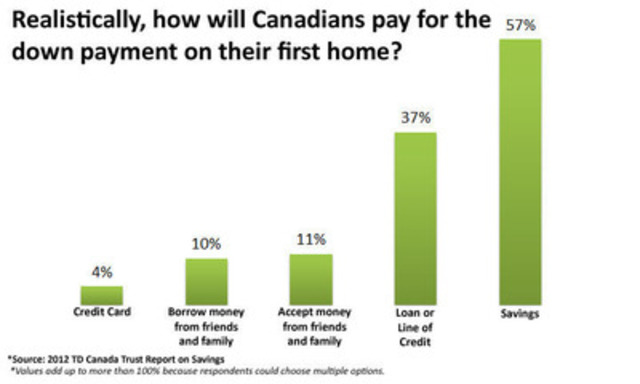

| More than one third of Canadians (37%) admit they would rely on a loan or line of credit to finance a deposit on their first home, but Moffatt says a down payment should ideally come from a homebuyer's savings. | |

| "A home is probably the biggest purchase you'll ever make. Coming up with a sizeable down payment proves that you are ready to take on the responsibility of a mortgage, plus the more you pay upfront, the more you save in the long run," says Moffatt, who encourages people to aim to save 15-20% for a down payment. | |

|

He also reminds people to consider how the on-going costs of

homeownership will factor into their budget now and in the future.

"Many times a first home can be followed quickly by a first baby. If

you're buying a first home and hoping to start a family, make sure your

budget reflects your plans and allows some room for growth. A new baby

brings joy and excitement, but can also mean added expenses and

possibly a reduced income if you take maternity leave." |

Balancing debts and savings

Forty-one percent of Canadians find it difficult or impossible to balance their current debts and save for the future while still enjoying their life today. To get their debt load under control, a number of Canadians consider tapping into savings (34%), selling assets (29%), consolidating debts (32%), getting a second job (27%), and even borrowing money from family (10%).

Moffatt says the most important aspect of balancing your debts and savings, is creating a detailed budget so you get an accurate understanding of where your money is going and where you can find opportunities to save. "Take advantage of the free tools, like online cash flow calculators and budgeting templates, to help get in control of your finances," he says.

About the 2012 TD Canada Trust Report on Savings

TD Bank Group commissioned Environics Research Group to conduct an online omnibus survey of 1,022 Canadians 18 years of age or older. Responses were collected between January 23-27, 2012.

About TD Canada Trust

TD Canada Trust offers personal and business banking to more than 11.5 million customers. We provide a wide range of products and services from chequing and savings accounts, to credit cards, mortgages and business banking, to credit protection and travel medical insurance, as well as advice on managing everyday finances. TD Canada Trust makes banking comfortable with award-winning service and convenience through 24/7 mobile, internet, telephone and ATM banking, as well as in over 1,100 branches, with convenient hours to serve customers better. For more information, please visit: www.tdcanadatrust.com. TD Canada Trust is the Canadian retail bank of TD Bank Group, the sixth largest bank in North America.

Saving for Life's First - British Columbia release PDF available at: http://files.newswire.ca/431/BC-RELEASE.pdf

Saving for Life's First - Alberta release PDF available at: http://files.newswire.ca/431/ALBERTA-RELEASE.pdf

Saving for Life's First - Ontario release PDF available at: http://files.newswire.ca/431/ONTARIO-RELEASE.pdf

Saving for Life's First - Quebec release PDF available at: http://files.newswire.ca/431/QUEBEC-ENGLISH-RELEASE.pdf

Image with caption: "Saving for Life's Firsts Infographic (CNW Group/TD Canada Trust)". Image available at: http://photos.newswire.ca/images/download/20120604_C5170_PHOTO_EN_14511.jpg

Image with caption: "Graph: Realistically, how will Canadians pay for their first car? (CNW Group/TD Canada Trust)". Image available at: http://photos.newswire.ca/images/download/20120604_C5170_PHOTO_EN_14504.jpg

Image with caption: "Graph: Realistically, how will Canadians pay for their wedding and honeymoon? (CNW Group/TD Canada Trust)". Image available at: http://photos.newswire.ca/images/download/20120604_C5170_PHOTO_EN_14507.jpg

Image with caption: "Graph: Realistically, how will Canadians pay for the down payment on their first home? (CNW Group/TD Canada Trust)". Image available at: http://photos.newswire.ca/images/download/20120604_C5170_PHOTO_EN_14506.jpg

Image with caption: "Graph: Percentage of Canadians comfortable taking on debt for life's firsts (CNW Group/TD Canada Trust)". Image available at: http://photos.newswire.ca/images/download/20120604_C5170_PHOTO_EN_14505.jpg

Liz Christiansen / Jillian Turgeon

Paradigm Public Relations

416-203-2223

lchristiansen@paradigmpr.ca / jturgeon@paradigmpr.ca

Tamar Nersesian

TD Bank Group

416-944-7095

tamar.nersesian@td.com

Get News Alerts by Email

Receive breaking news from TD Bank Group directly to your inbox.